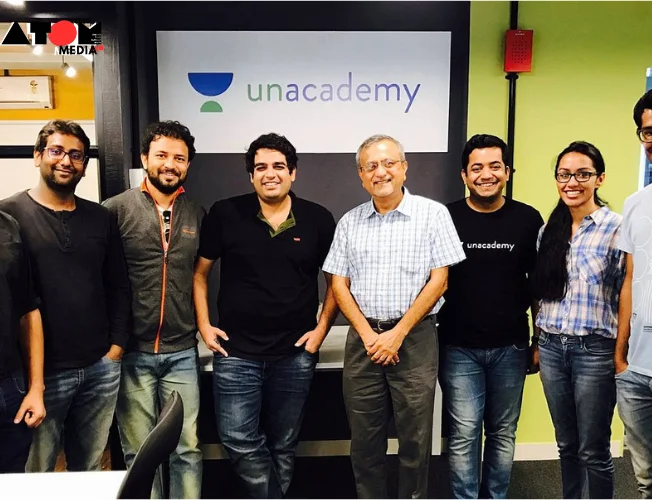

The edtech unicorn Unacademy, financed by SoftBank, has modified the objectives that were originally set for its co-founders, Gaurav Munjal and Hemesh Singh, with regard to giving them bonus shares that will grant them more voting rights in 2022. This change in goals provides a window into Unacademy’s developing goals in the context of the shifting startup funding ecosystem.

Revisiting Targets for Founders’ Voting Rights

According to Unacademy’s filings with the Registrar of Companies (RoC), Munjal and Singh can now receive extra voting rights provided that the firm forms an IPO committee by March 2025 in order to proceed with the preparation of its initial public offering. The initial goal of raising $200 million within three years of the bonus share offering, as authorised by the board of the firm in May 2022, has been replaced by this amendment.

Implications and Industry Observations

Industry insiders believe that this action is a sign of Unacademy’s evolving goals and the general downturn in startup capital. Venture investors have adopted a more cautious attitude since the middle of 2022 due to a global trend away from cheap loan rates, which has forced firms to save money and concentrate on profitability.

Evolution of Unacademy’s Strategy

In May 2022, Unacademy began issuing bonus shares to its institutional investors and founders, with the exception of Roman Saini, who was one of the initial co-founders. With an anticipated initial public offering (IPO) in the near future, the company’s move indicates a strategic change towards achieving sustainability and optimising cost structures.

Financial Resilience and Strategic Decisions

Unacademy’s strong cash reserves and deliberate focus on lowering cash burn demonstrate its tenacity. Munjal made a statement in December 2023 that emphasised the company’s substantial cash reserves, which are equal to four years’ worth of operating runway and a 60% decrease in cash burn.

Looking Ahead

Even though the creation of an IPO committee is a big step towards a possible public offering, Unacademy is still committed to growing its offline test preparation business in the cutthroat market. The company’s strategy changes, in spite of difficulties, show a practical approach to negotiating the changing startup ecosystem.

Final Thoughts

The move by Unacademy to adjust the goals for founders’ voting rights demonstrates its flexibility and strategic vision in the face of shifting market dynamics. In order for the business to grow sustainably and maybe go public, it will be crucial that it maintains both its financial stability and its strategic flexibility.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News