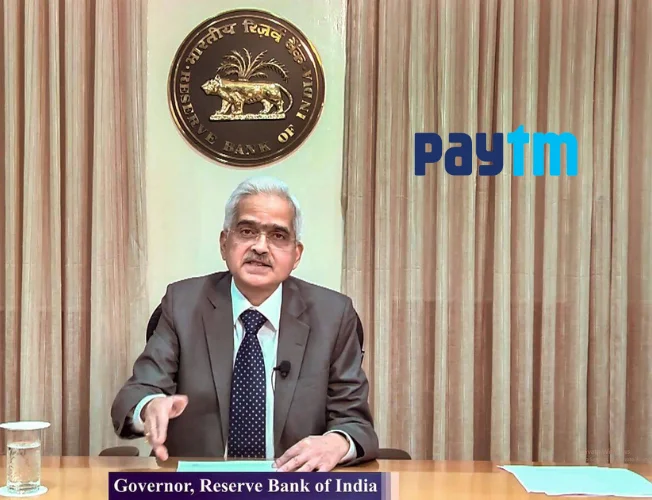

Vijay Shekhar Sharma, CEO of Paytm, faced a challenging situation after the Reserve Bank of India (RBI) imposed restrictions on the company’s digital wallet and other services. Seeking guidance, Sharma met with Finance Minister Nirmala Sitharaman, but the outcome was succinct and direct.

Government’s Hands-off Approach

During the brief 10-minute meeting, Sharma was informed by government officials that the government holds no authority over the recent RBI restrictions. The message conveyed was clear: Paytm must address the regulatory concerns directly with the RBI.

Paytm’s Regulatory Hurdles

The RBI’s directive, issued last week, instructed Paytm to cease its digital wallet, deposit, and credit products, prompting a significant downturn in Paytm’s shares by over 40%.

Engagement with RBI

Following his meeting with the Finance Minister, Sharma engaged with RBI officials to discuss the regulatory issues at hand. The focus was on finding a resolution and ensuring compliance with the RBI’s guidelines.

RBI’s Restrictions

The RBI’s directives specifically prohibited Paytm Payments Bank Ltd from accepting deposits or facilitating credit transactions after February 29. While customers can continue to use existing balances without restrictions, new deposits will not be accepted.

Assurance to Customers

Despite the regulatory challenges, Paytm Payments Bank assured its customers that their funds are secure. However, customers will not be able to deposit additional funds into their accounts or wallets after the specified date.

Continued Operation

Despite the restrictions, Paytm affirmed that its app will continue to function normally beyond February 29, providing reassurance to users regarding uninterrupted service.

Conclusion

As Paytm navigates through the regulatory hurdles imposed by the RBI, the company remains committed to addressing the concerns and ensuring compliance. The government’s stance underscores the need for Paytm to work directly with regulatory authorities to resolve the issue effectively.

Read more.. Marketing News, Advertising News, PR and Finance News, Digital News.