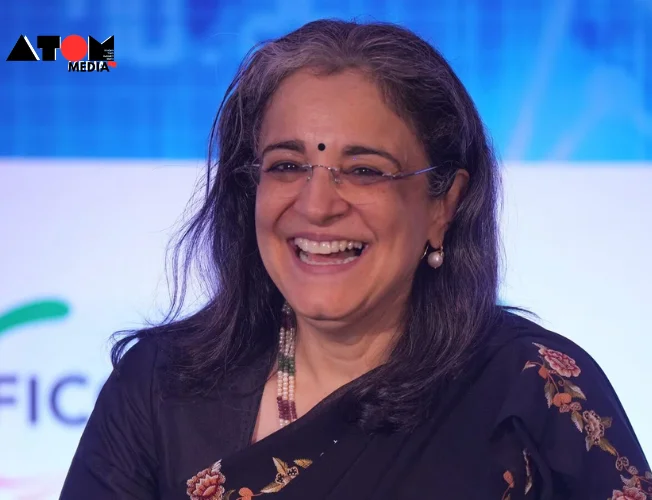

The Securities and Exchange Board of India (Sebi) is set to hold a crucial board meeting today, September 30, 2024. This gathering marks the first official meeting since allegations surfaced from the US-based short-seller Hindenburg against Sebi Chairperson Madhabi Puri Buch. The meeting will be attended by Sebi’s four whole-time members and three part-time members, reflecting the regulatory body’s commitment to addressing pressing issues in the financial market.

Hindenburg’s Allegations

Hindenburg Research has accused Madhabi Puri Buch and her husband, Dhaval Buch, of having investments in offshore funds allegedly controlled by Vinod Adani, the brother of industrialist Gautam Adani. The short-seller has previously claimed that the Adani Group manipulated funds and inflated the stock prices of its listed companies in India. Although Sebi conducted a thorough investigation into these allegations and subsequently cleared the Adani Group of wrongdoing, the situation has sparked significant concerns among investors.

Impact on Investor Sentiment

The ongoing controversy surrounding Madhabi Puri Buch has left investors on edge. The accusations against the Sebi chairperson have raised questions about the integrity of the regulatory body and its oversight capabilities. As the meeting approaches, market participants are closely monitoring the developments, anxious about how these allegations may impact regulatory practices and investor confidence.

Employee Concerns and Internal Pressure

Compounding the situation, approximately 500 Sebi employees have expressed their discontent by writing to the finance ministry. They have reported immense pressure within the regulator, contributing to what they described as a “stressful and toxic work environment.” These internal dynamics have further fueled speculation regarding the effectiveness and morale of Sebi’s workforce.

In response to the allegations of an unprofessional work culture, Sebi initially stated that such claims were unfounded and suggested that “outside elements” were instigating employee grievances. However, the regulator later retracted these comments, committing to address the issues raised “amicably and internally.” This back-and-forth adds another layer of complexity to the regulatory body’s current challenges.

A Critical Meeting for Sebi

As the Sebi board convenes today, all eyes will be on how they address the allegations against Chairperson Madhabi Puri Buch and the broader implications for the regulatory environment in India. Investors are keenly awaiting clarity on the regulator’s stance and how it plans to maintain integrity in its operations moving forward.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News