RBI Stands Firm on Regulatory Action

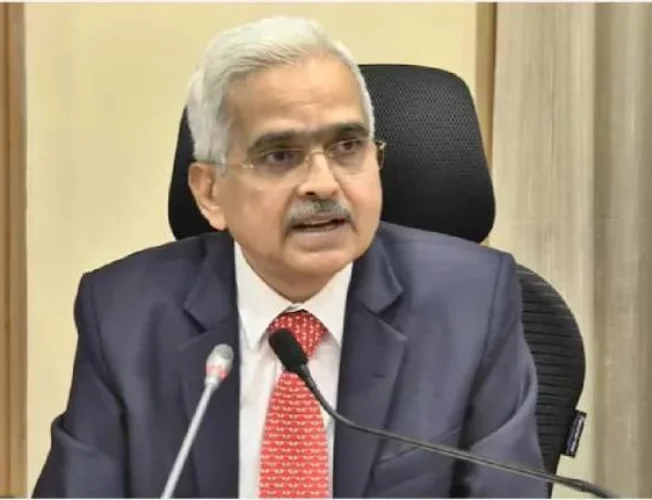

Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday unequivocally stated that the central bank won’t reconsider its recent actions against Paytm Payments Bank (PPBL). This decision follows a comprehensive assessment of the bank’s operations.

“There is no review of this decision,” Das declared at a press conference after the RBI’s central board meeting. “Let me very clearly say, there is (going to be) no review of the decision,” emphasizing the finality of the action.

Balancing Growth and Stability

While acknowledging the importance of the fintech sector, Das stressed the RBI’s commitment to both supporting innovation and protecting customer interests. “We are supportive of the fintech sector,” he said, “but we are also committed to protect the interest of customers as well as ensure financial stability.”

Recap of the Action

On January 31st, the RBI prohibited PPBL from accepting any new deposits or transactions, effectively freezing its operations. This action, effective February 29th, 2024, included restrictions on credit transactions, top-ups, and deposits to all customer accounts, wallets, and prepaid instruments.

Reasons for the Action

The RBI had previously cited “persistent non-compliance” as the reason for taking action against the Paytm subsidiary. Governor Das reiterated this point, stating, “We give sufficient time to every entity to comply. If they would comply, why would a regulator like us would have to take action?”

No Concessions or Government Intervention

Reports indicate that the RBI denied any concessions to Paytm, including an extension of the February 29th deadline. Additionally, Finance Minister Nirmala Sitharaman clarified to Paytm founder Vijay Shekhar Sharma that the action was purely regulatory and the government wouldn’t intervene.

Consequences for Paytm

While Paytm has maintained that the impact on its overall business is minimal, the RBI’s action has undoubtedly affected the bank’s operations and customer base. The company is currently exploring alternative approaches to navigate this situation.

Read more.. Marketing News, Advertising News, PR and Finance News, Digital News.