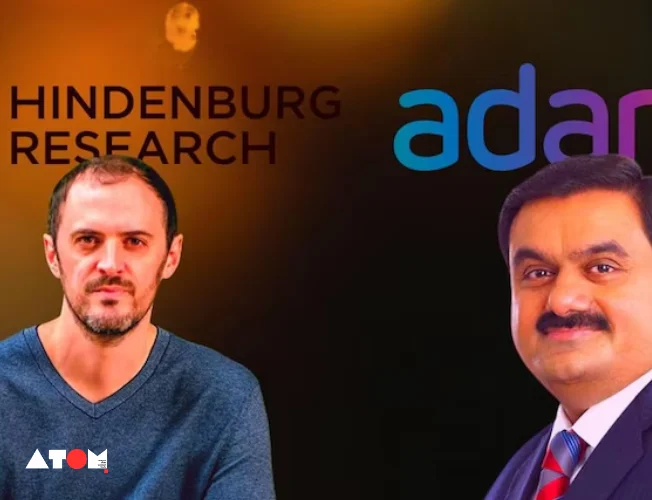

In a recent statement, Hindenburg Research has sharply criticized the Securities and Exchange Board of India (SEBI) for its handling of the allegations made against the Adani Group in Hindenburg’s January 2023 report. The US-based short-seller accused SEBI of failing to address the alleged fraud and corporate misconduct outlined in their report on the Indian conglomerate led by billionaire Gautam Adani.

Background of the Allegations

Hindenburg Research’s report accused the Adani Group of engaging in widespread corporate malfeasance, including stock price manipulation and related-party transactions. The report labeled these actions as “the largest con in corporate history,” leading to a significant impact on the market valuation of Adani’s listed companies, wiping out more than $150 billion at one point. The Adani Group has consistently denied these allegations.

SEBI’s Response and Hindenburg’s Criticism

In June, Hindenburg Research received a notice from SEBI stating that their report on the Adani Group contained certain misrepresentations and inaccuracies meant to mislead readers. Hindenburg responded with a statement on their website, claiming that SEBI seemed more interested in pursuing those exposing such practices rather than addressing the issues raised in the report.

Hindenburg’s statement read, SEBI has neglected its responsibility, seemingly doing more to protect those perpetrating fraud than to protect the investors being victimized by it.

Legal and Regulatory Actions

Following the release of Hindenburg’s report, India’s Supreme Court ordered SEBI to investigate the allegations against the Adani Group. The court also set up an expert panel to examine potential regulatory lapses. In January 2024, the Supreme Court asked SEBI to conclude its investigation within three months, emphasizing that no further probes were needed.

Despite these orders, Hindenburg Research criticized SEBI’s progress, stating that the investigation had hit a wall. SEBI has not yet responded to Hindenburg’s recent comments. An Adani Group representative also declined to comment on the situation.

Market and Industry Impact

The controversy surrounding the Adani Group and the subsequent fallout from Hindenburg’s report have had significant implications for the Indian market. The report’s allegations led to a dramatic decline in the market value of Adani’s companies, raising concerns among investors and stakeholders about corporate governance and regulatory oversight in India.

The case has also highlighted broader issues within India’s financial regulatory environment. Hindenburg’s criticism of SEBI underscores the challenges faced by regulatory bodies in balancing investor protection with corporate accountability. The situation has prompted discussions on the need for more robust regulatory frameworks and greater transparency in corporate practices.

Moving Forward

As the investigation continues, the focus remains on SEBI’s ability to address the allegations and ensure that appropriate measures are taken to protect investors and maintain market integrity. Hindenburg Research’s call for greater accountability and transparency serves as a reminder of the importance of vigilant regulatory oversight in safeguarding the interests of all market participants.

The outcome of SEBI’s investigation will be closely watched by the global investment community, as it will set a precedent for how similar cases are handled in the future. Investors and analysts will be looking for signs of strengthened regulatory practices and a commitment to upholding the highest standards of corporate governance.

Hindenburg Research’s recent criticism of SEBI over its handling of the Adani report allegations has brought renewed attention to the issues of corporate governance and regulatory oversight in India. As the investigation progresses, the actions taken by SEBI will be crucial in restoring investor confidence and ensuring the integrity of the market.

This high-profile case serves as a critical test for India’s financial regulatory framework, highlighting the need for continued vigilance and accountability in monitoring corporate practices. The investment community will be watching closely to see how SEBI addresses these challenges and what steps are taken to prevent similar issues in the future.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News