Fresh Investment for Biotech Startup Mynvax

In an extended Series A investment round, Bengaluru-based biotech startup Mynvax successfully raised Rs 21.63 crore, or roughly $2.6 million. After a nearly three-year break, this round, led by Inviga Healthcare Fund, represents a major milestone for Mynvax.

Special Resolution Passed for Fundraising

Mynvax’s board has approved a special resolution to issue 5,127 Series A1 CCPS at an issue price of Rs 42,182 per share, raising Rs 21.63 crore, according to regulatory records accessible from the RoC. With an initial investment of Rs 15 crore, Inviga Healthcare Fund took the lead, followed by Rs 2 crore from Legacy Assets LLP. Twenty-seven other investors made modest contributions to the remaining capital.

Valuation and Previous Funding Rounds

With this new funding, Mynvax is valued at approximately Rs 257 crore, or $31 million after funding. With the help of Lets Venture, 1Cword, Kotak Investments, and others, Accel led a $4.2 million Series A round that brought the biotech startup’s total fundraising to about $9–10 million.

About Mynvax and Its Technology

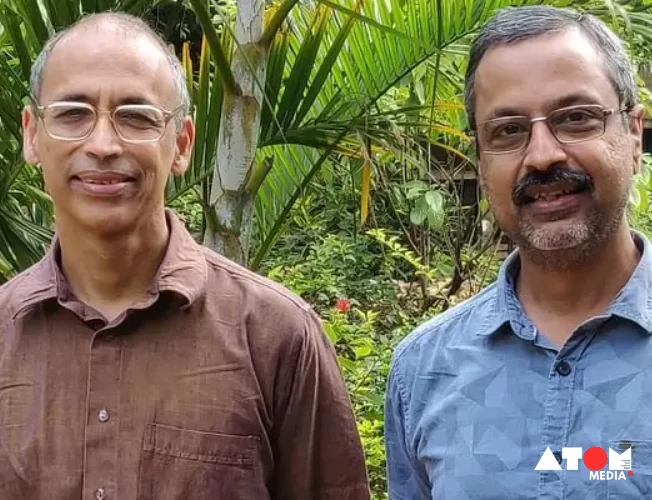

Mynvax, which was founded in 2017, is an innovative company that specializes in creating customized protein subunit vaccines by stabilizing proteins using cutting-edge technology. The development of influenza vaccines and thermo-tolerant, effective vaccinations against SARS-CoV-2 and its developing variations are among the company’s primary emphasis areas. With 15.63% of the shares in Mynvax after the most recent fundraising round, Accel is still the biggest external stakeholder, followed by Kotak Investment and Inviga. Gautam Nadig and Raghavan Varadarjan, the co-founders of Mynvax, jointly own a 24.7% share in the business.

Financial Performance and Growth Trajectory

Notwithstanding the obstacles presented by the pandemic, Mynvax demonstrated remarkable expansion in its operating income, which increased by 89% to Rs 10.94 crore in the fiscal year that concluded in March 2023. Nonetheless, the business declared losses of Rs 6.43 crore for the same time frame. The company has not yet submitted its financial results for the most recent fiscal year (FY24).

The funding round’s success highlights investor faith in Mynvax’s creative strategy and ability to tackle important healthcare issues. With a solid investor base and an emphasis on developing ground-breaking vaccines, Mynvax is well-positioned to achieve noteworthy progress in the biotech sector and create wealth in the years to come.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News