The real estate sector has greeted the Reserve Bank of India’s (RBI) decision to keep the repo rates unchanged at 6.5%, emphasizing its positive impact on homebuyers and market affordability.

Continued Low Interest Rates Benefit Homebuyers

Experts note that the RBI’s decision provides relief to homebuyers, allowing them to benefit from sustained low interest rates amidst rising housing prices across major cities. This decision marks the sixth consecutive time that the repo rate remains unchanged, offering stability to equated monthly installments for homebuyers.

Policy Stability and Market Outlook

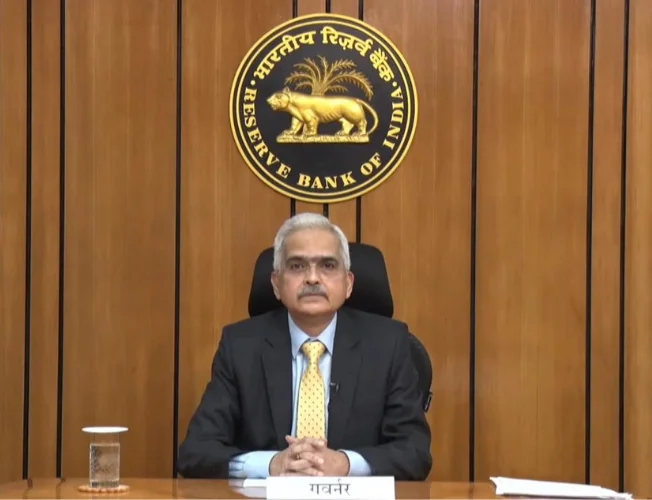

RBI Governor Shaktikanta Das, in the bi-monthly monetary policy announcement, affirmed the MPC’s decision to maintain the repo rate at 6.5%. The move is anticipated to bolster the services sector and construction activity, driven by robust domestic demand and government spending.

Positive Implications for the Real Estate Market

The pause in the rate hike cycle is welcomed by the real estate sector, as it fosters steady interest rates and enhances buyer confidence, thereby supporting continued growth in the residential market. This stability is projected to lead to a surge in home loan affordability, potentially surpassing 300,000 units in sales for the year 2024.

Industry Perspectives

Industry leaders express optimism regarding the potential impact of stable interest rates on the housing market. They anticipate sustained momentum in sales, coupled with increased affordability, resulting in a positive consumer sentiment.

Expectations for Future Developments

While the current decision aligns with market expectations, experts hope for future reductions in interest rates to further bolster affordability and stimulate demand in the real estate sector. The anticipation is for a conducive policy environment that sustains market growth and supports the housing loan portfolio of banks.

Conclusion

Overall, the real estate sector views the RBI’s decision as a favorable development, contributing to market stability and affordability for homebuyers. The industry remains hopeful for continued policy measures aimed at fostering growth and revitalizing sentiment in the housing market.

Read more.. Marketing News, Advertising News, PR and Finance News, Digital News.