The Dynamics of Personal Loans and Credit Scores

Personal loans can significantly influence your credit score, but the impact can be both positive and negative. It’s crucial to understand how managing your personal loan affects your creditworthiness and financial health. One of the most critical factors in determining the impact of a personal loan on your credit score is how responsibly you manage its repayment. Missing any installment can have adverse effects on your credit score, highlighting the importance of timely payments.

Negative Impact of Defaulting

Defaulting on a personal loan can severely damage your credit score. Since payment history plays a crucial role in credit scoring, any instance of late payment can cast a shadow on your creditworthiness.

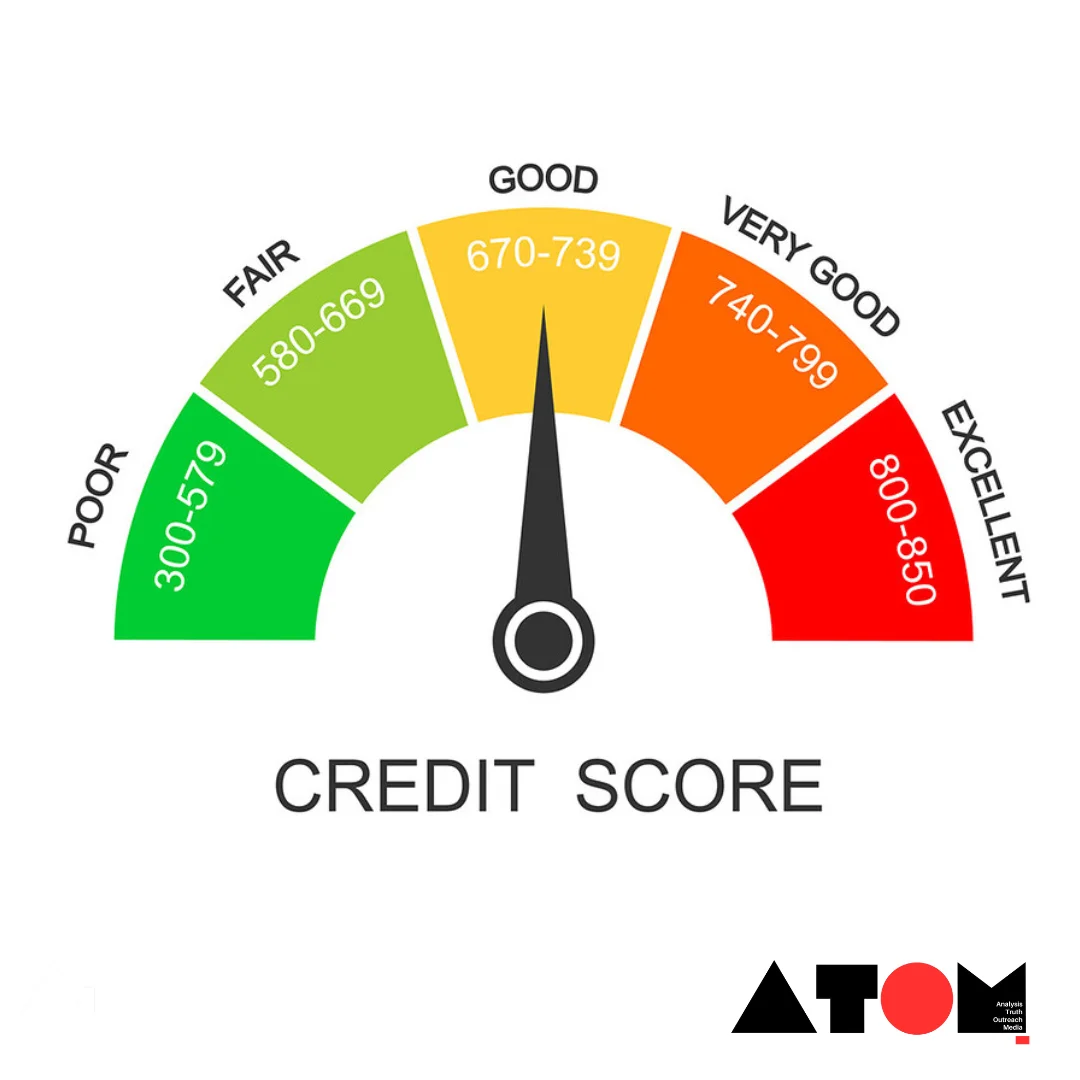

Factors Influencing Credit Score

Several factors influence how personal loans affect your credit score. Personal loans can increase your total available credit, potentially lowering your credit utilization ratio. A lower ratio typically reflects positively on your credit score. Making regular, timely payments on your personal loan demonstrates reliability to lenders and positively impacts your credit score. Taking out a personal loan may slightly decrease the average age of your credit accounts. However, as you make on-time payments and maintain good standing, it contributes positively to your credit history. Having a diverse mix of credit types, including installment loans like personal loans, can positively affect your credit score. Lenders prefer borrowers who demonstrate the ability to manage different types of credit responsibly. Applying for a personal loan results in a hard inquiry on your credit report, which can temporarily lower your credit score. However, if managed well, the positive effects of responsible loan management outweigh the temporary drop caused by the inquiry.

Responsible Management for Positive Impact

Managing your personal loan responsibly by making timely payments and avoiding defaults can have a positive impact on your credit score. It improves your payment history, credit mix, and credit utilization, enhancing your overall creditworthiness. Frequently asked questions about credit scores provide insights into understanding and improving your creditworthiness.Checking your credit report does not impact your credit score and is advisable to monitor regularly.Timely payments, reducing debt, and maintaining a healthy credit utilization ratio are essential for improving your credit score.Protecting personal and financial information is crucial to prevent identity theft and fraud.

Understanding these dynamics can help individuals make informed decisions about managing personal loans and maintaining a healthy credit score. Navigating the complexities of personal loans and credit scores requires a comprehensive understanding of how various factors interact. By managing personal loans responsibly and staying informed about credit scoring mechanisms, individuals can safeguard their financial well-being and access better lending opportunities in the future.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News